Cashback credit cards are a fantastic way to stretch your rupee further. Every swipe earns you a percentage of your spending back, essentially giving you a discount on everything you buy. But with so many cashback cards in India, choosing the right one can be overwhelming. Fear not, deal hunters! This blog unveils the best cashback credit cards in India, helping you pick the perfect one to maximise your savings.

For Amazon enthusiasts, this card is a no-brainer. Earn a whopping 5% cashback on all your Amazon purchases, with no annual fee. Plus, you get reward points on other categories and access to exclusive Amazon deals.

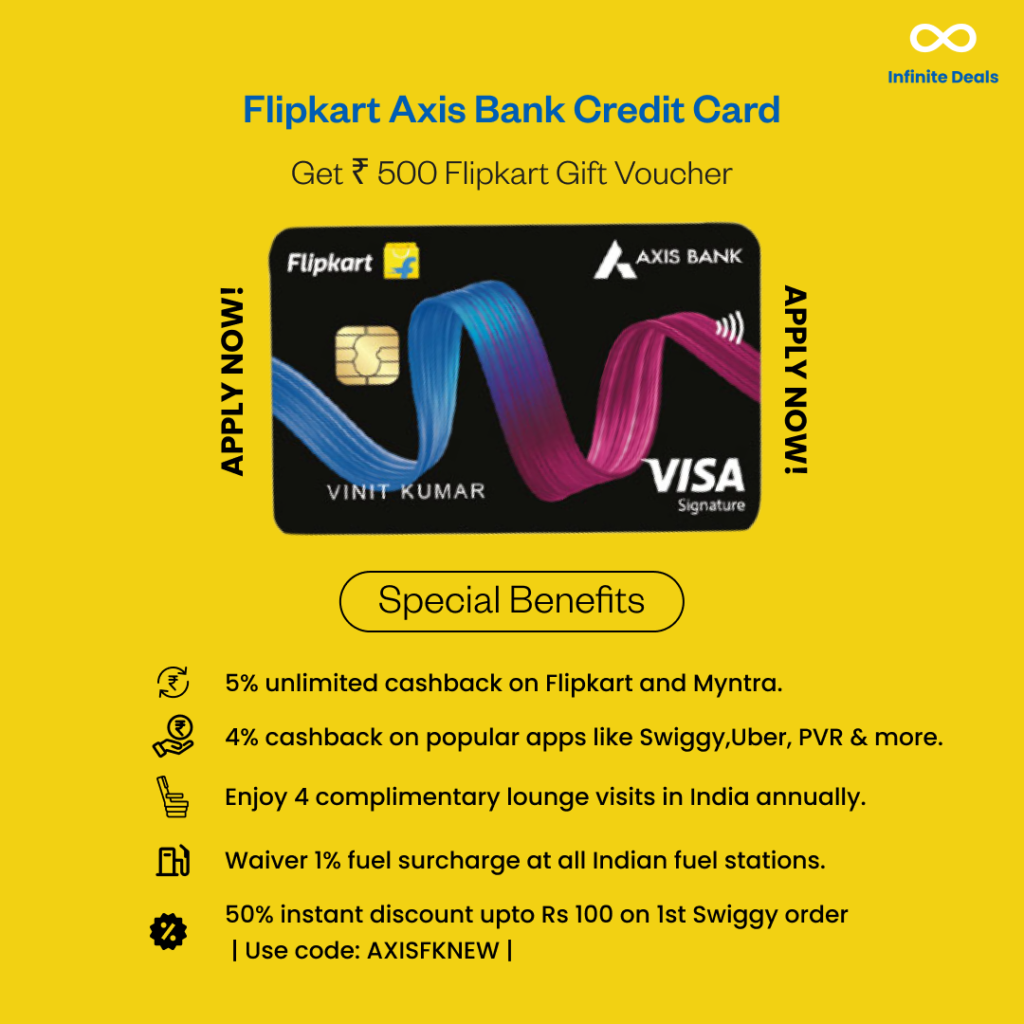

Flipkart shoppers rejoice! This card grants you a flat 5% cashback on Flipkart purchases and 2% cashback on other online spending. The annual fee is nominal, and you get additional benefits like movie tickets discounts and reward points.

This card offers a well-rounded cashback program with 5% cashback on departmental stores, utility bill payments, and grocery purchases (up to a monthly limit). With a reasonable annual fee, it’s a good choice for everyday spending.

This feature-rich card provides 5% cashback on online transactions (up to a monthly limit) and reward points on other categories. It also offers travel insurance, airport lounge access (limited visits), and movie ticket discounts for a premium annual fee.

Cashback Rate: Compare cashback rates across different cards and categories to see where you can maximise your rewards.

Annual Fee: Weigh the annual fee against the potential cashback earned. Some cards with higher cash back rates might have a premium annual fee.

Spending Habits: Choose a card that rewards your spending patterns. If you spend heavily on groceries or online shopping, prioritise cards with high cash back in those categories.

Bonus Categories: Look for cards with bonus cash back categories that align with your spending habits.

Remember, responsible credit card usage is key. Always pay your bills in full and on time to avoid interest charges and maximise your savings.

While credit cards are widely advertised, the ideal one hinges on your spending habits and financial goals. Don’t get swept away by flashy offers! Dive deep into reviews, compare features, and explore resources like Infinite Deals to find the perfect match. Remember, the best credit card isn’t just about impressive benefits – it’s the one that complements your financial lifestyle. Leverage this guide, identify your priorities, and embark on your quest for the ideal credit card deal in 2024. Infinite Deals offers insights on the latest deals and rewards programs for various credit cards, but remember to explore all options to find the card that aligns perfectly with your budget and spending patterns!

Follow Us on Social Media for Daily Deals & updates

© 2024 Infinite Deals Inc. All rights reserved.

WhatsApp us